What is gross rental value (GRV)?

The gross rental value (GRV) is the total annual rent a property might reasonably be expected to earn each year if it was rented out. This includes associated rates, taxes, charges, insurances, and other outgoings. For non-residential properties, GST is also included.

The GRV is determined by the Valuer-General for all rateable and leviable properties in Western Australia. Landgate provides these figures to rating authorities who use it to work out the rates, service charges, and levies that property owners must pay.

These rating authorities include:

- local councils for rates

- water providers (e.g. Water Corporation WA) for water and sewerage rates

- the Department of Fire and Emergency Services (DFES) for the emergency services levy, which is included on your council rates.

Each rating authority sets their own rate in the dollar to be charged. The rate in the dollar figure is multiplied by the GRV, with the local council adding levies (e.g. rubbish collection) to calculate the total rates payable. You should find details of the GRV and rate in the dollar used to calculate your rates in the bill notice.

If you have any queries on the rate in the dollar or levies, please contact your respective local council or rating authority.

How and when is the GRV determined?

Step 1: Date of valuation (DOV)

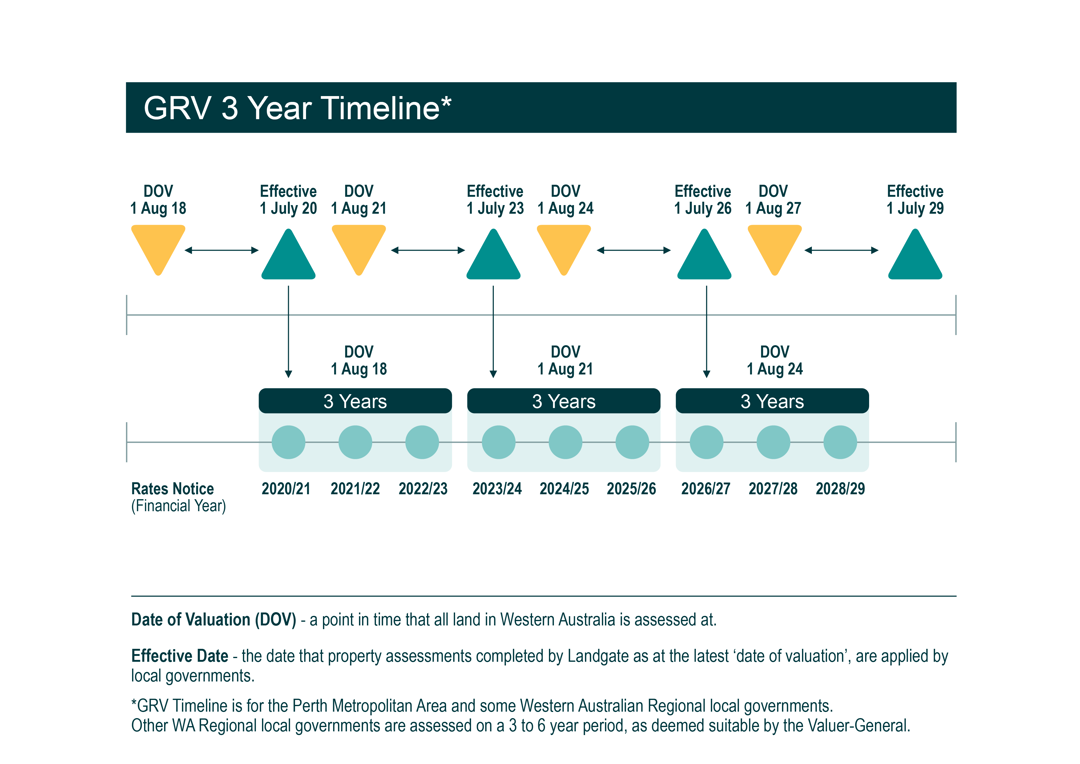

To ensure a fair and equitable assessment is completed, all properties within a local government are assessed by our valuers at the same date, which is known as the date of valuation.

The assessment is conducted every 3 years for the metropolitan area and 3 to 6 years for regional areas, depending on the local government.

Find details of the most recent date of valuation for metropolitan and regional local governments.

Step 2: Rental evidence is collected and analysed to determine GRV

Valuers at Landgate collect and analyse evidence at the date of valuation to establish property market levels.

To determine a fair rental value for each property, individual property attributes and constraints are considered. These may include:

| Residential | Non-residential |

|

|

For non-residential properties, council rates, water rates, land taxes, building insurance and GST may also be included.

Step 3: GRV is applied to your rates on the effective date

Given the time it takes to determine the GRV for all properties, there is an elapsed time between the date of valuation and the effective date of the GRV (when the valuation can be applied to generate rates or charges). For local governments located in the metropolitan area this timeframe is 23 months, while for regional areas this timeframe is 11 months.

See how the GRV is applied to your rates notice over a 3-year period in the diagram below.

For any further queries on the GRV, please contact our Customer Service team.

Frequently asked questions

For land that is undeveloped, a GRV is still determined by Landgate. As rental evidence cannot be used for this assessment, a statutory valuation of 3% of the unimproved value (UV) is applied to properties designated as residential and 5% for properties designated as non-residential properties.

If you are unsure if your land has been classified as residential or non-residential, please contact us.

Below are example GRV calculations for undeveloped land with an unimproved value of $250,000.

| Property Classification | I want to know how the GRV is calculated for undeveloped land | I want to know what UV was used to calculate the GRV for undeveloped land |

| Residential | $250,000 (UV) multiply by 0.03 = $7,500 (GRV) | $7,500 (GRV) divide by 0.03 = $250,000 (UV) |

| Non-residential | $250,000 (UV) multiply by 0.05 = $12.500 (GRV) | $12,500 (GRV) divide by 0.05 = $250,000 (UV) |

Due to the volume of valuations and expansive land area of Western Australia to be covered, the most cost-effective approach is to conduct GRVs on a 3-year basis for the metropolitan area and 3 to 6 years for regional areas, depending on the local government.

Completing valuations on a more frequent basis would see higher rates and charges for property owners.

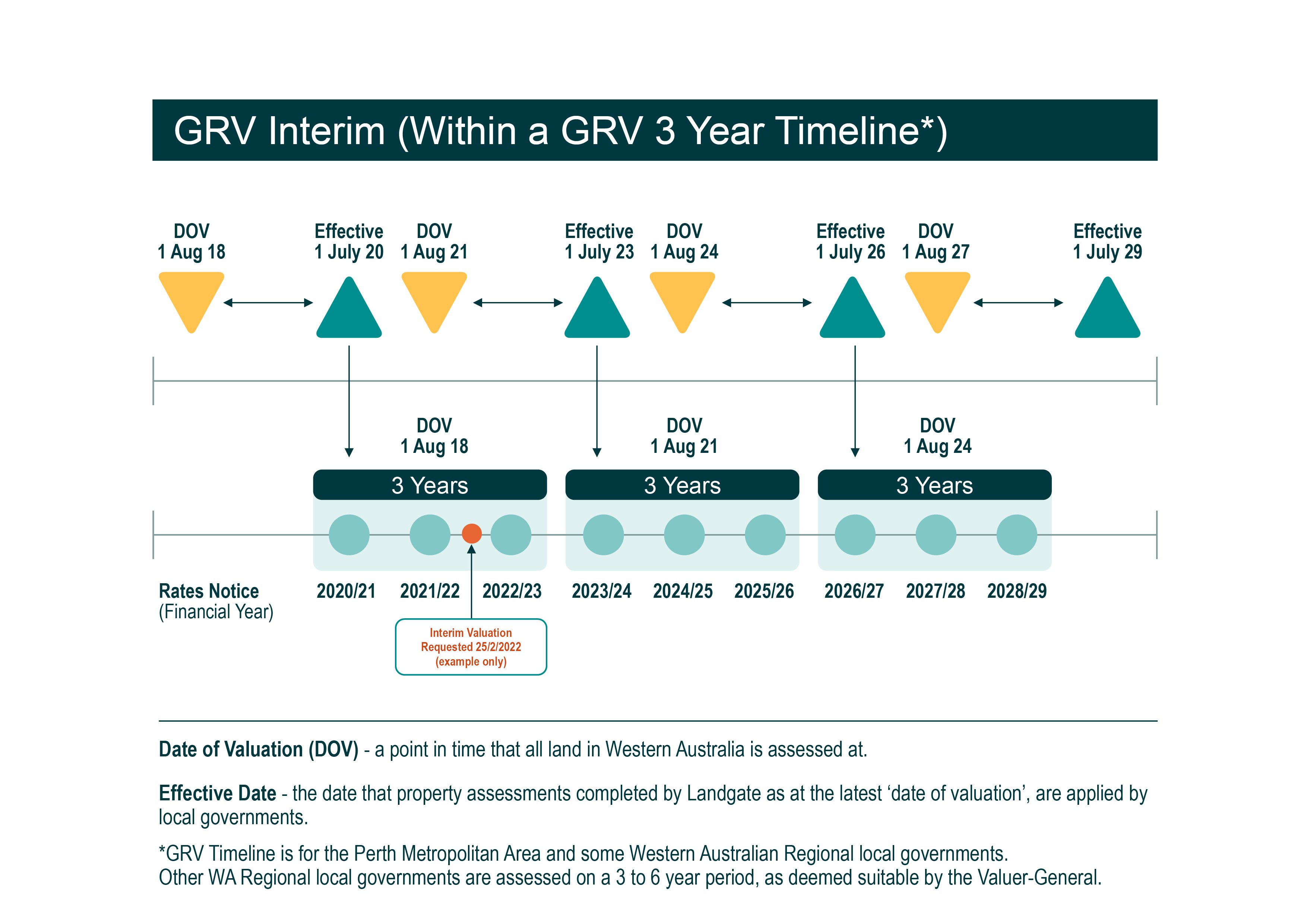

Your local council or water provider will advise Landgate of any additions, improvements or demolitions, subdivisions, or amalgamations that have been actioned on your property.

Our valuers will review rental evidence as at the latest date of valuation and update the GRV. This will reflect the changes that have been made to your property as if they were in place as at the latest date of valuation.

The new GRV will be provided to the rating authorities including your local council, who will recalculate your rates and taxes for the remaining period in the current financial year. A rates or taxes adjustment notice will then be issued by the rating authority to advise you of any additional charges or if a refund is due to you.

See the diagram below for an example of how an interim GRV is applied to your rates notice.

While Landgate is responsible for determining the GRV of your property, each rating authority sets their own rate in the dollar to be charged. If you have any queries on the rate in the dollar or levies, please contact your respective local council or rating authority.

If you still have questions or concerns about your GRV, please contact us.

If your concern is unresolved, you may wish to lodge a formal objection online. Find out how to lodge an objection.